Markets hate uncertainty, the old adage goes, so there was some relief among investors that American voters had made a clear-cut decision.

Days or weeks of political and legal wrangling over the outcome of the US election would probably have proved hugely turbulent on financial markets – and destabilising for the global economy and geopolitics.

So while the return of Donald Trump to the White House as president will stir strong feelings for many, investors can start to plan for the coming years with at least some clarity. Chaos is rarely good for investors.

Many Britons are direct investors in the US, with the lucky ones owning some shares in the high-tech giants, such as Apple, Microsoft and Amazon, that have shot up over the past couple of years.

Anyone with a private sector pension will have some assets in the US.

Stability: While the return of Donald Trump to the White House as president will stir strong feelings for many, investors can start to plan for the coming years with at least some clarity

The American market accounts for 60 per cent of global equities and every balanced portfolio will own some shares there. Beyond that, the dollar anchors world trade and investment.

US Treasury securities – debt issued by the American government – are the main investment held as reserves in the world’s central banks.

And, of course, the US is not only the world’s largest economy, well clear of China, but is increasing its lead over Europe.

So what happens now?

The verdict on the markets was mixed. US stock markets soared alongside the dollar and bitcoin, but European markets fell as did US government bonds, pushing up yields or borrowing costs.

These are the so-called ‘Trump trades’ in action.

Leading up to polling day, the received wisdom was that a Trump win would be better for US equities and worse for bonds, while a Kamala Harris presidency would be the other way round.

The argument was that the Republicans will be more pro-business than the Democrats, and that the tax cuts they have promised will, in the short run at least, boost economic growth and corporate profits.

The downside is likely to be higher inflation, leading to higher interest rates, and more government debt.

And there are implications for the global economy – including Britain – not least the threat of a global trade war if Trump carries out his threat to ramp up tariffs on imports to the US. These fears saw early gains on European benchmarks, including the FTSE 100 share index, evaporate.

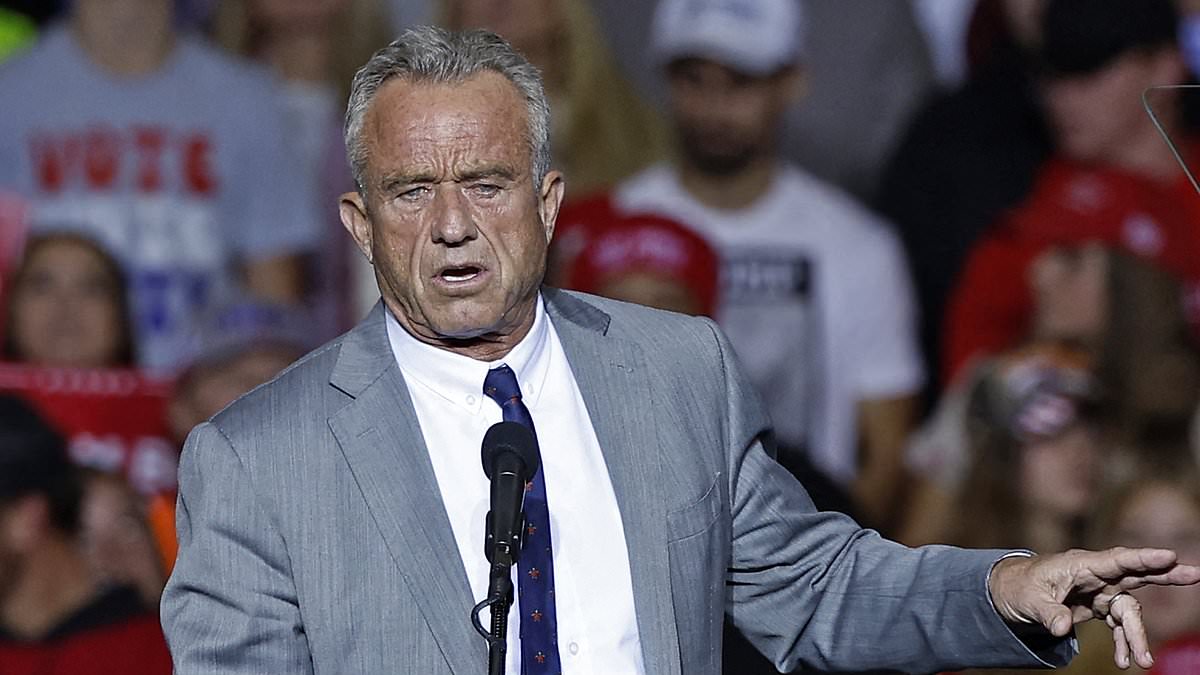

Anxiety: There are concerns that Musk (pictured on the election campaign trail) does not spend enough time running Tesla given distractions including his support for Trump

What should you do?

History suggests you should put political allegiances to one side and stay invested in the stock market – no matter who is in the White House.

And analysts reckon there are plenty of options – as well as risks – for those wishing to cash in on a Trump victory.

Here are ten investments experts believe are worth looking at, though each carries a risk.

Exxon Mobil

Trump has long been seen as a friend of big oil and any move to favour fossil fuels and deregulate the industry should benefit

Exxon Mobil, says Susannah Streeter, head of money and markets at investment platform Hargreaves Lansdown.

‘Trump’s win is likely to bring Exxon regulatory relief, including relaxed environmental restrictions and lower corporate taxes, both of which could enhance profitability and support increased domestic production,’ she says.

JP Morgan Chase

Streeter also believes the financial sector will benefit from Trump’s return to the Oval Office, with JP Morgan Chase, America’s largest bank, her pick of the bunch.

‘He is expected to bring a continued focus on deregulation and lower taxes,’ she explains.

‘A lighter regulatory touch might reduce compliance costs and stimulate capital markets through favourable policies.’

BAE Systems

European defence stocks rallied yesterday on expectations of increased military spending on this side of the Atlantic.

Trump has threatened to scale back US military support for Europe and force Nato members to spend 2 per cent or more of their national output on defence – piling pressure on the UK, Germany, France and others to do more.

BAE Systems rose 4.9 per cent, or 63p, to 1,343p, and 11 of the 20 analysts who follow it rate the stock as a ‘buy’ while just one says sell.

Rolls-Royce is also fancied by analysts, with 13 saying ‘buy’ and just one ‘sell’, even with shares at a record high following a six-fold increase since ‘Turbo’ Tufan Erginbilgic took over as chief executive at the start of last year.

Ashtead Group

THE biggest riser on the FTSE 100 yesterday was Ashtead Group, which hires out equipment, from barriers and fencing to excavators and forklift trucks under the Sunbelt Rentals brand.

Analysts at broker Peel Hunt say 91 per cent of its profits will come from America in 2025, where it will benefit from ‘the proposed cuts to corporation tax that could stimulate slightly higher levels of private sector investment’.

Dan Coatsworth, an analyst at financial platform AJ Bell, agrees, saying: ‘Its longer-term prospects should improve under Trump.’

Ferrexpo

Also on the rise in London was Ferrexpo, which operates three iron ore mines and an iron ore pellet production plant in Ukraine and stands to benefit if Trump can help end the war with Russia.

Neil Wilson, chief market analyst at financial planner Finalto, says the jump in the shares – up 27.3 per cent, or 17p, to 79.2p – is a ‘Ukraine peace play’.

‘Given its Ukrainian mine and processing plant, Ferrexpo currently encapsulates the potential of a settlement in Ukraine,’ add analysts at Peel Hunt.

Trump Media Technology

Wilson also describes Trump Media Technology – the parent of the president elect’s social media platform Truth Social – as ‘one to watch for obvious reasons’.

The shares were up 6 per cent last night, though this paled in comparison to early gains of more than 30 per cent, underlining its volatility.

Trump set up Truth Social in 2021 after he was removed from Twitter, and the stock has closely tracked his election prospects.

There is also speculation that X – as Twitter was renamed when it was bought by Trump’s ally Elon Musk – may be planning to buy the company.

Tesla

Talking of Musk, Daniel Ives of Wedbush Securities believes the return of Trump could push Tesla shares up from near $250 before the result to more than $300, giving it a value of $1trillion.

‘The biggest positive from a Trump win would be for Tesla and Musk,’ he says.

He also notes that while the end of tax breaks for electric vehicles would be bad for the industry as a whole, it could be ‘a huge positive’ for Tesla because of its dominant position.

There are concerns, however, that Musk (pictured left on the election campaign trail) does not spend enough time running Tesla given distractions including his support for Trump and other business interests including Space X.

Bitcoin

Bitcoin surged to a record high above $75,000 as it became clear Trump was on course to win the presidency.

Crypto experts and enthusiasts believe he will usher in a softer line on regulation for the industry, with Standard Chartered analysts saying it could hit $200,000 next year.

Sceptics, however, warn that bitcoin has no intrinsic value and anyone who does invest should be prepared to lose everything.

Artemis US Smaller Cos

The ‘American First’ push is likely to benefit small and midcap stocks in the US, which, according to Nick Wood, head of fund research at wealth manager Quilter Cheviot, are ‘currently undervalued compared to mega caps’.

He argues that Trump’s focus on domestic companies makes the Artemis US Smaller Companies fund attractive, particularly given its ‘strong long-term track record due to excellent stock selection’.

British American Tobacco

A change in regulation of nicotine companies could also present opportunities, says Chris Beckett, head of equity research at Quilter Cheviot.

And a US clampdown on Chinese vaping firms would benefit British American Tobacco, which is the market leader in this area through its Vuse brand.

‘Restricting Chinese imports or holding them to the same standards would be a big positive for BAT,’ says Beckett.

DIY INVESTING PLATFORMS

AJ Bell

AJ Bell

Easy investing and ready-made portfolios

Hargreaves Lansdown

Hargreaves Lansdown

Free fund dealing and investment ideas

interactive investor

interactive investor

Flat-fee investing from £4.99 per month

Saxo

Saxo

Get £200 back in trading fees

Trading 212

Trading 212

Free dealing and no account fee

Affiliate links: If you take out a product This is Money may earn a commission. These deals are chosen by our editorial team, as we think they are worth highlighting. This does not affect our editorial independence.

Compare the best investing account for you

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.